Us Tax Brackets 2025 Married Filing Separately - Tax Bracket 2025 Married Filing Separately Excited Dacia Dorotea, How to file your taxes: 2025 Tax Rates Married Filing Jointly Over 65 Carol Cristen, 2025 federal income tax brackets;

Tax Bracket 2025 Married Filing Separately Excited Dacia Dorotea, How to file your taxes:

2025 Tax Brackets Married Jointly Single Myrle Tootsie, Find the 2025 tax rates.

Us Tax Brackets 2025 Married Filing Separately. See the 2023 tax tables. To figure out your tax bracket, first look at the rates for the filing status you plan.

What’s My 2025 Tax Bracket?, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples.

Us Tax Brackets 2025 Married Jointly Olva Tommie, See the 2023 tax tables.

2025 Married Filing Jointly Tax Brackets Emlynn Marcia, 2025 federal income tax brackets and rates.

Tax Season Guide Married Filing Jointly vs. Separately Chime, How to file your taxes:

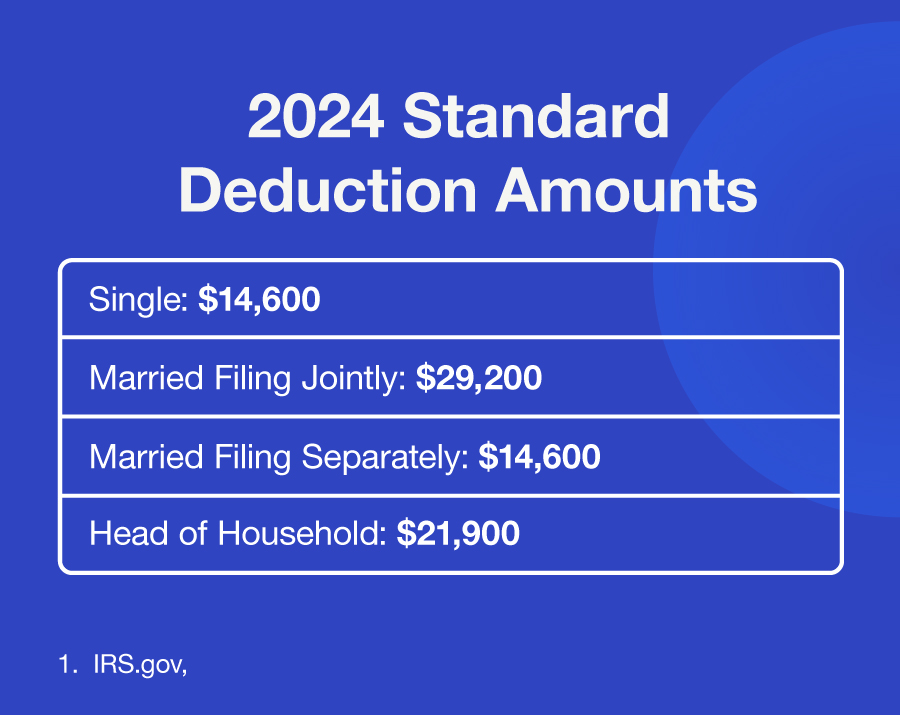

Tax rate taxable income (married filing separately) taxable income (head of household)) 10%: See the 2023 tax tables.

2025 Tax Brackets Announced What’s Different?, Yep, this year the income limits for all tax brackets will be adjusted for inflation,.

Us Tax Brackets 2025 Married Jointly Over 65 Ethyl Janessa, 2025 federal income tax brackets and rates.

Irmaa Brackets 2025 Married Filing Jointly Bobbe Cinnamon, 2025 federal income tax brackets and rates.